MAP Fund

Better member outcomes

English | ΕλληνικάStrategies

MAP offers the following Investment Strategy Fund options:

- Cash only: Seeks to preserve capital and liquidity in nominal terms gross of fees. This would usually be suitable for people with shorter term horizon.

- Defensive: Designed to provide a high probability that the return on your account will be at least equal to the inflation over time plus a small margin in order to reduce as far as possible fluctuation in values. This would usually be suitable for people with shorter term horizons or those who do not want to have annual fluctuations in their balances.

- Moderate: Designed to provide a higher long-term return than Defensive option in a balanced way aiming to provide moderate fluctuation in values but offer good growth potential. This is usually suitable for people with medium to long term investment horizons.

- Growth: Designed to provide higher long-term return with higher volatility aiming to control the fluctuation in values and offer higher growth potential than the Moderate and Defensive options in the long term. This is usually suitable for people with long term investment horizons.

- Dynamic: Designed for members that want a higher expected return and risk potential compared with the Growth option. This is usually suitable for people with long term investment horizons.

You choose your investment risk profile

| Primary investment objective | |

| The primary objective is to invest prudently so that the reasonable expectations of members can be met at the level of risk chosen by the member. The Administration Committee is responsible for investing the Fund assets in a prudent manner/in line with members' preferences. The Administration Committee's key aim is to provide a range of investment options to members that are suitable for meeting members' long and short-term investment objectives. They have taken into account members' circumstances, in particular the range of members' attitudes to risk and term to retirement. | |

| Strategic objectives | |

| Cash only |

Risk Objective: Risk that the 1-year nominal gross rate of return is lower than -0.5% p.a. with 5% probability. Time horizon: 1 year. |

| Defensive |

Risk Objective: Risk that the 10-year rate of return is Inflation-3.0% or lower with 5% probability. Time horizon: 10 years. |

| Moderate |

Risk Objective: Risk that the 10-year rate of return is Inflation-3.5% or lower with 5% probability. Time horizon: 10 years. |

| Growth |

Risk Objective: Risk that the 10-year rate of return is Inflation-4.5% or lower with 5% probability. Time horizon: 10 years. |

| Dynamic |

Risk Objective: Risk that the 10-year rate of return is Inflation-6.1% or lower with 5% probability. Time horizon: 10 years. |

| Return objective | |

| Maximizing the expected rate of return subject to the above risk objectives. | |

The permissible asset allocation ranges and the long term midpoints for each Investment Strategy Fund option to the different strategic asset classes are shown below.

The detailed investment strategy of MAP Fund is set out in detail in the

latest Statement of Investment Principles (SIP).

The Administrative Committee has the responsibility to continuously monitor the investments and take appropriate actions as needed.

The allocation of each strategy is reviewed at least quarterly, taking into account medium-term views and global economic and market developments.

The deviations from the long term mid-points are subject to permissible range limits.

| Investment Strategy Fund Options |

Permissible Asset Allocation Ranges |

Long Term Midpoints |

||||

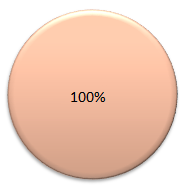

| Cash only |

Global Equity: none Alternatives: none Global Bonds: none Cash & Loans to members: 100% |

|

||||

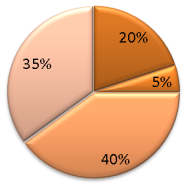

| Defensive |

Global Equity: 10%-30% Alternatives: 0-15% Global Bonds: 25%-55% Cash & Loans to members: 20%-70% |

|

||||

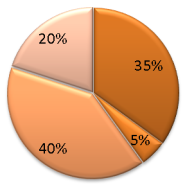

| Moderate |

Global Equity: 25%-45% Alternatives: 0-15% Global Bonds: 25%-55% Cash & Loans to members: 10%-50% |

|

||||

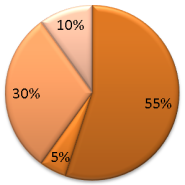

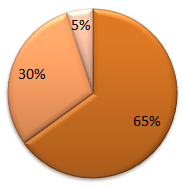

| Growth |

Global Equity: 45%-65% Alternatives: 0-15% Global Bonds: 15%-45% Cash & Loans to members: 0-40% |

|

||||

| Dynamic |

Global Equity: 50%-70% Alternatives: 0-10% Global Bonds: 20%-40% Cash & Loans to members: 0%-25% |

|

||||